FACTORING RESOURCES

Working Capital Financing Options

Apr 29, 2021

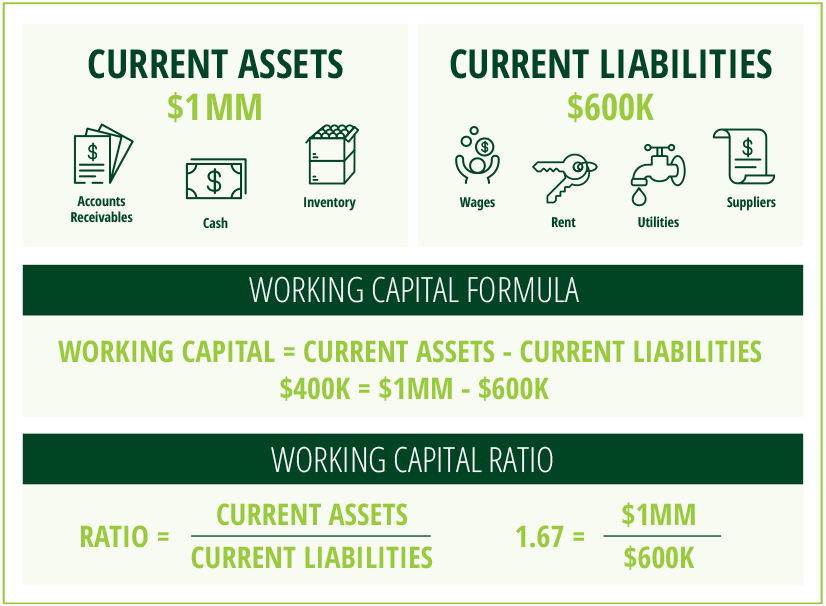

Defined as the amount of money a business has on hand to pay for short-term expenses, working capital is an effective way to measure a business’s short-term financial security. In practical terms, working capital is the money that allows a business to pay those it owes, like vendors or financial institutions, as well as cover expenses such as employee salaries, contractors, and taxes.

For example, if a company has $1,000,000 in current assets and $600,000 in current liabilities, the working capital ratio is 1.67 and the net working capital is $400,000. By most standards, any ratio within the 1.2 to 2.0 range is considered healthy. Ratios above 2.0 might mean that the company’s resources are not fully maximized.

Challenges in predicting working capital

While the formulas are straightforward, managing your working capital requires accurate forecasting. A few trends that are impacting working capital include:

- Longer payment times. According to a 2021 working capital survey from C2FO, 37% of respondents said late payments from customers had increased in 2020. The increase makes it more challenging to predict on-hand cash.

- Quickly changing demand. In the last year, we have seen businesses experience dramatic swings in service and product demand as a response to lockdowns, changing regulations, and economic activity. This variable demand makes it difficult to accurately predict the cash flow needed.

- Longer and stricter bank financing approval. For businesses who need a line of credit, remote working, among other factors, has led to longer approval times. In addition, banks are being more selective about who they approve financing for because of the increased risk. This means many businesses need to look beyond bank financing they have depended on in the past to meet their working capital needs.

- Disruptions in supply chain. As a result of container shortages, COVID outbreaks, shipping back-ups, and more, lead times from overseas and even domestic production are taking longer than usual. Businesses typically need to pay either partial or in full upfront, so the longer lead times are creating a cash flow challenge.

What are the options for working capital financing?

If you find that your working capital ratio has fallen below 1.0 and you do not have a revolving line of credit with the bank, here is an outline of the options to improve your cash position.

- Short-term loan

A short-term loan is taken to finance regular business operations or an emergency expense. It is intended to be a short-term financial solution and is not meant for long-term purchases such as equipment, real estate, or construction. These usually include a fixed rate and payment period of less than two years. A business usually needs good credit and a minimum of 2-3 years in business to receive a short-term bank loan. - Invoice Factoring

If your business sends invoices after delivering goods or services to your customer, factoring, also know as accounts receivables financing, can solve working capital challenges. Factoring is when your business sells its invoices to another company at a discount. In particular, if your working capital challenges are related to long customer payment terms, factoring can fund short-term expenses without sending your business into debt.

Essentially factoring allows your business to skip the wait once you send an invoice and get paid right away. If your company does not have great credit or has not been in business long enough to establish credit history, factoring is an ideal solution. This is because factoring is based on your customer’s credit, not your business’s credit. Additional benefits to factoring include no restrictions on how funds are used, quick approval times, and you retain all company ownership. - Merchant Cash Advance (MCA)

If a business does not qualify for a line of credit, it might be tempting to turn to MCAs. MCAs are a type of financing where funding is repaid by withholding a fluctuating percentage of debit and credit card sales. We only recommend pursuing this type of financing as a last resort and if you can repay it very quickly. While we have seen MCA providers offer enticing upfront rates and very quick approval, rates ultimately range from 40% to 350%! MCA loans are not a good long-term solution to cash flow challenges. For more about the challenges with MCAs, read about our customer who saves over $100,000 by switching from MCA loans to factoring.

It is important to choose the right type of financing to solve your current financial position. If you need working capital financing, call us at 281-870-9182 or email us at [email protected] to schedule a free consultation with our team. We can make recommendations custom to your business’s financial health.

References:

- https://www.c2fo.com/newsroom/c2fo-releases-2021-working-capital-outlook-survey-findings/

- https://www.nav.com/blog/working-capital-loans-81071/

- https://www.revenued.com/articles/business-loans/guide-to-understanding-mca-vs-traditional-bank-loans/

- https://www.investopedia.com/terms/w/workingcapitalmanagement.asp