Oilfield Services Financing

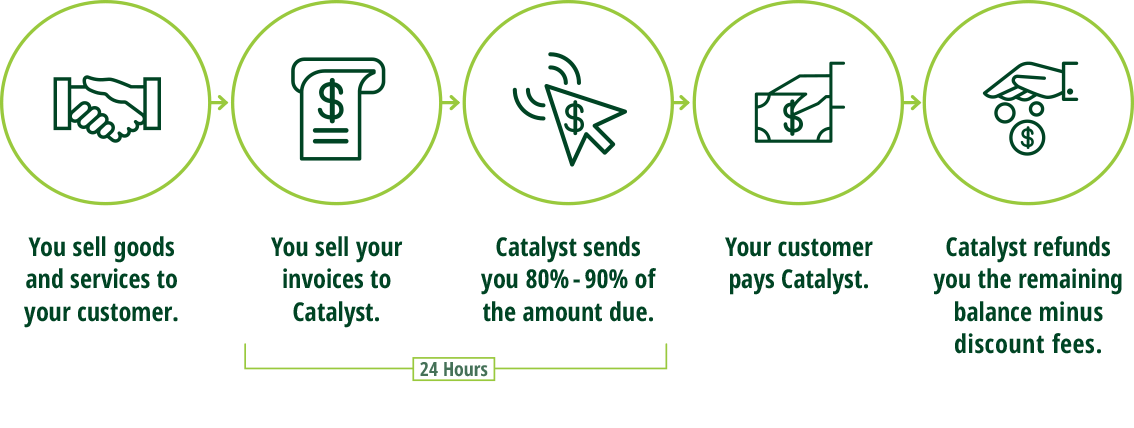

Invoice factoring gets oilfield service companies cash faster.

For more than 30 years, Catalyst has provided oilfield services financing options. We have worked with many entrepreneurs to launch or grow their energy sector businesses. While the sector offers many lucrative opportunities, we understand the risk and volatility that is inherent with serving oil and gas companies.

If you are a new or growing business, you typically cannot wait 30-90 days for payment after providing services. You have payroll demands, equipment costs, and other operating expenses that are likely due now.

We help fill the gap and get you cash as soon as your invoice is generated.

At Catalyst, we specialize in this kind of oilfield services financing, commonly referred to as invoice purchasing, factoring, or accounts receivable financing. We can help you significantly improve cash flow at reasonable, competitive rates. We also know your customers and their requirements, so we can help you get started quickly.

Why factor with Catalyst:

Our team provides a level of service and personalized attention uncommon in our industry. You'll have a direct contact who manages your account and provides assistance with credit decisions.

- Highly competitive rates

- No long-term contracts

- No maintenance fees

- Online reporting

- Rebates paid weekly

- Advance rates up to 90%

- Daily reporting of receipts

- Recourse and non-recourse programs

- No exit fees

- Equipment financing available

Request Oilfield Services Financing Now

Complete as much of this quick form as you can and we will get your approval started!

You can also call us at 281-870-9182 to start the approval process right now!

Oilfield Services Financing Case Studies

Your financial interests are our top priority.

No long term contracts means that as soon as your business is ready, we help you transition to a traditional bank line of credit. Many of our customers actually come to Catalyst because their banker refers them and trusts us to provide the best service. Our average customer works with us for 18-24 months before qualifying for a line of credit.